Lithium-ion batteries excel in grid storage due to their high energy density, efficiency, and ability to charge and discharge quickly. Unlike traditional storage methods like pumped hydro, which rely on specific geography, batteries can be deployed almost anywhere. They store excess energy when the sun shines or wind blows, releasing it during peak demand or when renewables are offline. This flexibility is critical as grids worldwide integrate more solar and wind, which generated 12% of global electricity in 2024, per the International Energy Agency.

The technology’s dominance is clear: lithium-ion batteries accounted for 90% of proposed grid storage systems in 2014, a trend that has only grown. Their ability to provide fast frequency regulation—adjusting power output in milliseconds—makes them ideal for stabilizing grids strained by fluctuating renewable inputs. For example, LG Energy Solution is shifting focus to produce lithium-iron phosphate (LFP) batteries in the U.S. for grid-scale storage, targeting applications like supporting AI data centers.

The Impact of Falling Battery Costs

A key driver of this shift is the dramatic drop in lithium-ion battery prices. In 2024, global prices for EV battery packs fell by 20%, the largest drop since 2017, reaching about $139 per kilowatt-hour, according to the International Energy Agency. This follows a 90% cost reduction from 2008 to 2023, when prices dropped from $1,415/kWh to $139/kWh in constant dollars. Lower costs make batteries viable for large-scale storage projects, where megawatt-hour-sized packs can support entire communities.

China leads this cost reduction, particularly with LFP batteries, which made up nearly half of the global EV battery market in 2024. LFP’s lower cost and improved performance have made it a go-to for both EVs and grid storage, especially in regions like Southeast Asia and Brazil, where its market share exceeds 50%. In the U.S., however, adoption lags at 10% due to tariffs on Chinese imports, though companies like GM and Ford are ramping up domestic LFP production.

Challenges of Oversupply

The battery production boom, while beneficial for costs, brings challenges. With supply outpacing EV demand, excess batteries risk sitting idle in warehouses, raising concerns about capacity fade—where batteries lose efficiency over time if unused. Manufacturers like CATL and BYD are vertically integrating, producing components like anodes and electrolytes in-house to streamline costs, but questions remain about long-term storage and recycling. If unsold batteries degrade, it could offset the economic benefits of oversupply.

Utilities also face hurdles in scaling grid storage. While lithium-ion batteries are efficient, their upfront costs and lifespan (typically 10-15 years for EVs, longer for stationary use) require careful planning. Innovations like immersion cooling, explored by SK On, aim to improve thermal management and extend battery life, but the industry must address how to manage surplus stock sustainably.

A Second Life for EV Batteries

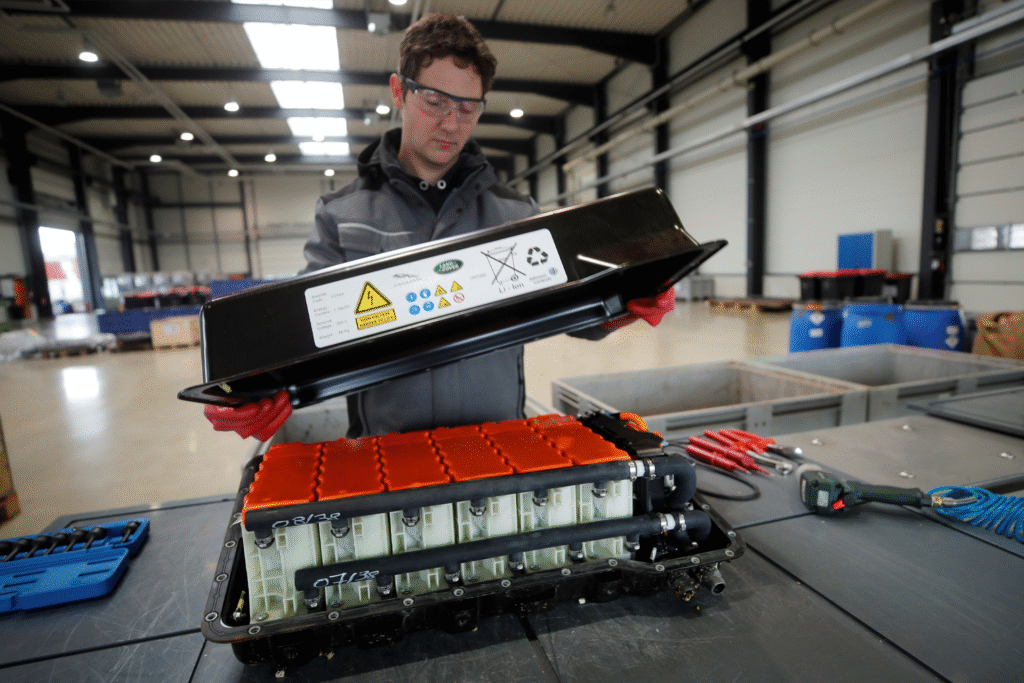

One promising solution is repurposing used EV batteries for grid storage. After 8-10 years in vehicles, batteries retain 70-80% of their capacity, making them ideal for less demanding stationary applications. For example, Toyota has partnered with Jera to use old EV battery packs, including lithium-ion and nickel-metal-hydride, to power a Mazda factory in Japan. These systems act as energy buffers, managing discharge with proprietary technology to maximize efficiency.

This “second life” approach extends battery lifespan, reduces waste, and lowers the cost of grid storage. In the U.S., projects are underway to recycle EV batteries or repurpose them for stationary use, addressing both environmental and economic concerns. With EV batteries expected to last 12-15 years in vehicles and decades in storage, this strategy could transform the energy sector.

The Road Ahead for Grid Storage

The rise of lithium-ion batteries in grid storage reflects a broader shift toward a cleaner, more resilient energy future. As renewable energy grows, batteries will play a critical role in smoothing out supply and demand. Innovations like sodium-ion batteries, which CATL is scaling for cold climates, and solid-state batteries, pursued by SK On and others, promise further advancements. However, the industry must navigate oversupply, recycling, and equitable access to ensure these benefits reach all communities.

For now, lithium-ion batteries are proving their worth beyond EVs, offering a lifeline to grids under pressure. As production ramps up and costs continue to fall, they’re not just powering cars—they’re powering progress toward a sustainable world.