A virtual power plant aggregates thousands of home battery systems—such as Tesla Powerwalls or Sunrun’s solar-plus-storage setups—to function like a traditional power plant, but without the environmental cost. These batteries, typically installed alongside rooftop solar panels, store excess energy generated during the day and discharge it to the grid when demand spikes, particularly between 7 and 9 p.m. This approach reduces reliance on fossil fuel-based peaker plants, which are costly and polluting. During the July event, the VPP’s output was enough to power over half of San Francisco, proving its scalability and reliability.

Sunrun’s Leading Role

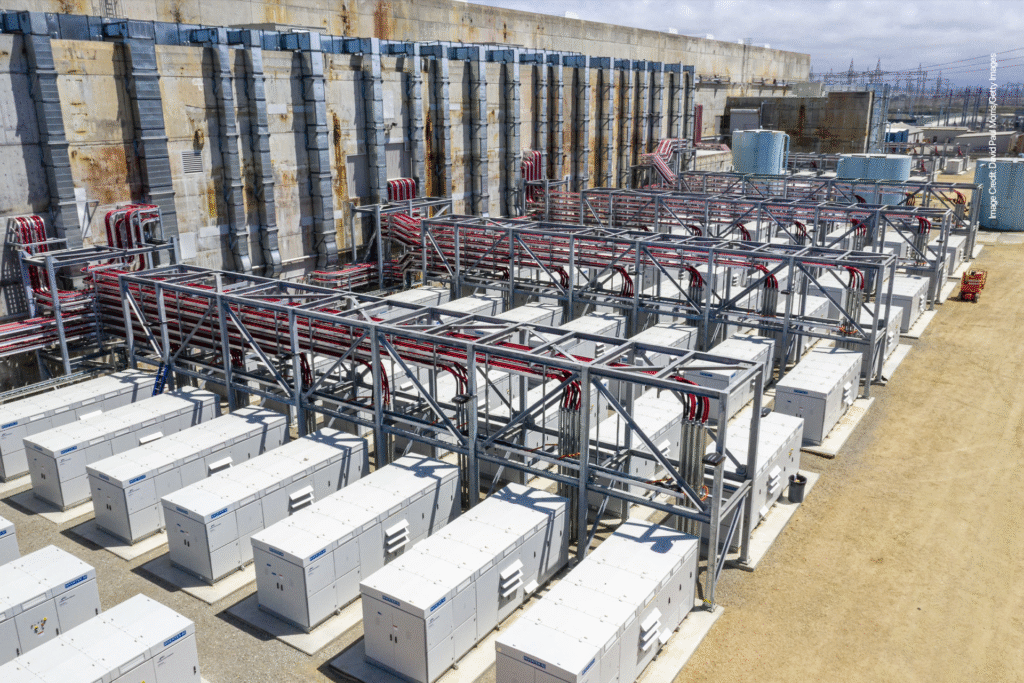

Sunrun, a major player in residential solar and storage, led the charge by supplying more than two-thirds of the energy during the test. The company’s CalReady VPP, now linking over 75,000 home batteries from 56,000 customers, delivered an average of 360 MW, with peak bursts reaching higher. This performance builds on earlier successes, such as a June 24 event where the fleet provided 325 MW. Sunrun compensates participants up to $150 per battery per season, incentivizing homeowners to contribute to grid stability while offsetting their own electricity costs.

Ryan Hledik, a principal at The Brattle Group, noted the event’s consistency, describing it as “dependable, planning-grade performance at scale.” Unlike traditional power plants, which require large-scale infrastructure, VPPs leverage existing home systems, eliminating single points of failure and enhancing grid resilience.

Why This Matters for California

California’s grid faces increasing strain from rising temperatures and growing electricity demand, particularly during evening hours when solar production drops. Home batteries address this challenge by smoothing out the “evening load ramp,” when utilities often resort to gas-powered plants. By providing clean energy during these critical periods, VPPs reduce greenhouse gas emissions, prevent blackouts, and mitigate price spikes. The Brattle Group’s analysis highlighted that the July event visibly reduced statewide grid load, potentially deferring the need for costly new power plants.

The state’s push for renewables is evident in its solar adoption: nearly 90% of Sunrun’s new California customers in 2024 paired their solar systems with battery storage. This trend, driven by rising utility rates and the impending end of the 30% federal solar tax credit in 2025, underscores the growing appeal of home energy solutions.

Broader Implications for Energy Systems

The success of California’s VPP highlights a shift toward decentralized energy. Unlike traditional grids reliant on centralized plants, VPPs distribute power generation across thousands of homes, making the system more flexible and resilient. This model aligns with global trends, as seen in projects like Massachusetts’ vehicle-to-grid pilot and Australia’s plans for bidirectional EV charging. Sunrun’s CEO, Mary Powell, called it a “customer-led energy revolution,” emphasizing how homeowners can drive systemic change while benefiting financially.

The July event also sets a precedent for future grid management. CAISO’s ability to coordinate with utilities and aggregators like Sunrun and Tesla demonstrates a scalable framework for integrating distributed resources. As battery adoption grows—spurred by incentives and falling costs—VPPs could become a cornerstone of clean energy infrastructure, not just in California but nationwide.

Challenges and Opportunities Ahead

While the July test was a triumph, scaling VPPs further requires overcoming hurdles. Regulatory frameworks must evolve to streamline participation and ensure fair compensation for homeowners. Additionally, expanding VPP capacity depends on broader adoption of home batteries, which can cost $5,000 to $15,000 before incentives. However, falling battery prices and programs like EnergySage, which connects consumers with vetted solar installers, are making these systems more accessible.

Looking forward, California’s VPP success could inspire other states to adopt similar models, especially as extreme weather events stress grids nationwide. With the U.S. battery storage market adding a record 12.3 gigawatts in 2024, the infrastructure for decentralized power is already taking shape. California’s home battery fleet is proving that the future of energy may lie not in massive plants, but in the collective power of individual households.